So you want to earn lots of money and become amazingly wealthy. You

have heard the rumours about Forex trading $3 trillion DAILY, and you

figure you want a piece of that, just a little bit as you are not

greedy…

So you now go out and buy the latest crazes of an EA, one copies the

trades of a real life trader, and the other is the best EA on the market

that shows that the creator (who used to work as a bin man, and now

codes EA’s and buys the latest sports cars etc) turned a measly $100 to

earning $56,637 per month stress free…

So you sit back and watch that investment of yours turn into zero over the course of a matter of days….

You wonder what could have gone wrong? Surely it could not have been

your fault… after all, you were not making the trades… it must have

been the software… of course it was!

Except what really went wrong, is that you fell for (yet another) marketing ploy.

Forex is a highly complex beast that requires attention, knowledge,

experience, emotional control, money and more than anything business

acumen.

This may sound strange, because all you are doing is pressing a button to buy or sell… it must be easy to make money?

Look at the flip side. Doctors spend about 10 years learning their

trade, and in this time they are spending money on their training. It

is not until they qualify that they start earning this money back, and

the promise of earning back much more than their investment. Saying

that, they still have to work exceptionally hard at it, pulling 24 hour

shifts, working 7 days on the trot, working over bank holidays, national

holidays, Christmas, New Year… Why would you think that they would do

that if Forex was so easy? Surely these highly intelligent people would

be far better plying their knowledge on the markets?

The reason is, is that not everyone is cut out for forex trading, and

secondly, not everyone has the business mind to become successful…

although his can be learned over a period of time.

So how do you make Forex trading a business? How do you treat it like one?

First and foremost, experience is key. Now I would not expect anyone to

trade for 10 years before having their first try in a live trading

account, but at the very least you should know how Forex works – this is

your basic business analysis and market research. The factors that go

into a trade, position sizing, money management – these should all be

learned and then applied to your strategy.

Once you fully understand this, it is now time to implement your

strategy. This could be someone else’s that you are using exactly, one

that you have found somewhere else but have adapted to your own style,

or one you have come up with yourself. Regardless of where you got your

strategy from, you need to test it.

When you test it, it is not a case of testing it for a couple of

trades and then diving in to the markets. You need to test for months

before you apply it to the market. This could be a demo account or a

micro account if you can afford to throw a couple of thousand dollars

away. You have to assume that you will lose any money you invest if you

are testing a system – you expect the worst and hope for the best.

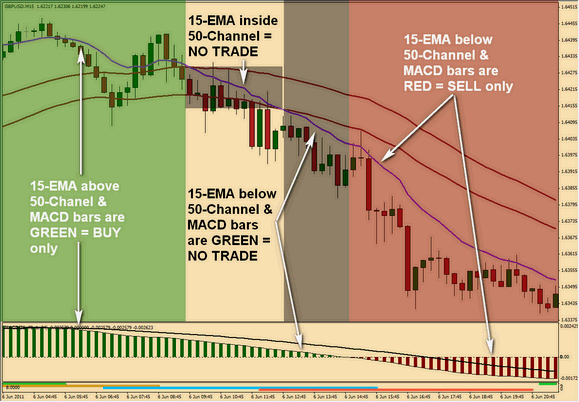

This is purely to see if the system works mechanicly (as in determining

your rules). This should be done on the higher time frames – 1 day, 4

hour etc. The reason being is because the higher the time frame, the

stronger the move.

You do this for 3 months continually. If you are successful, you can

look to trade the smaller timeframes, to test where the system works

best.

If you are not profitable, you start again for the 3 months and refine the system.

Rinse and repeat

The reason for this is that you are getting experience, you are doing

your market research, you are learning the drivers of your system. On

top of this, you are also minimising your losses (having a demo account-

you have zero losses) and maximising your learning curve.

Once you are profitable 3 months in a row and you are happy that you

have a system that works, you can go to a live trading account, but you

need to start small. Micro accounts are for this very purpose. Again

you need to be profitable 3 months in a row before you invest more, and

move up to a mini account or standard account.

If you change any part of the system, you need to go back to the demo stage.

It may seem overkill, but I can guarantee that any successful business

does not take unwarranted risk. Any strategy needs to be thoroughly

tested – think of manufacturing here, stress tests are done to ensure

the product is robust enough to succeed!

Would you rather spend 10 years perfecting and refining a system that

can earn you millions (yes it is possible) or spend 5 minutes blowing

your account through lack of knowledge?

Great traders are made over the course of years. No trader has ever

made it by pure luck. They know their market inside out, and they

adhere to strategies that are proven.

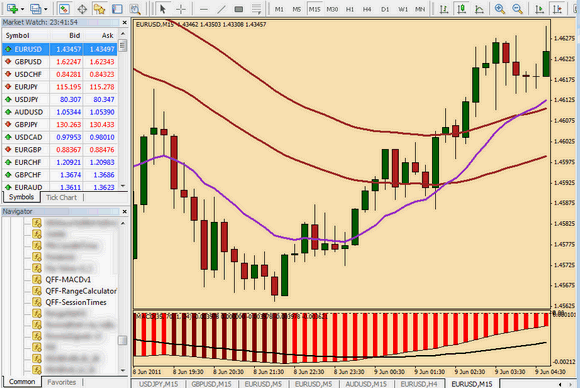

I keep a blog of the strategy I am implementing

-www.100percentforex.blogspot.com, and over the course of 2 months I

have refined my strategy and have not lost any money due to it being on a

demo account. I am still going to demo for another 2 months because I

want to succeed.

If you want to invest in Forex, invest in an education first, it will pay dividends at the end.

Have goals in mind, keep journals of all your trades so that you can

analyse them. Know when to enter a trade and more important exit a

trade. Know your risk, your position size, know the news coming out.

The more you know the more you are likely to succeed. Don’t believe the

hype surrounding the next big marketing release, they are destined to

fail and make you poorer.

Most of all, enjoy your trading! We want to be traders so that we

can work for ourselves – why take all the risk if you are not going to

enjoy it?

Happy trading!