My Journey to Forex master

Friday, August 24, 2012

Sunday, June 10, 2012

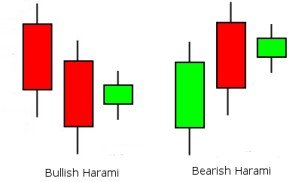

Harami – An Important Trend Reversal Candlestick Pattern

Harami is an important trend reversal pattern. It is a two day candlestick pattern with the candle of the setup day longer than the candle of the signal day. Harami is the Japanese word for pregnant. If you draw this a pattern, it will look like a pregnant woman. The pattern can be bullish as well as bearish.

In case of the bullish harami, the first day is a bearish candle that occurs in a downtrend. On the second day, bulls enter the market and start moving the prices higher but not with much success as the price close lower than the open of the first day and the first day’s high is not surpassed. However, when this pattern appears it culminates in a trend reversal.

If you want to identify the bullish harami pattern, it should have the following features. The market should be in a downtrend. The setup day has a longer candle than the signal day. The setup day candle has an open greater than the close and the body is fairly long.

The signal day candle has an open lower than the close. The open of the signal day is higher than the close of the setup day. The low of the setup day is lower than the low of the signal day and the high of the setup day is higher than the high of the signal day. The signal day open is higher than the setup day close and the signal day close is lower than the setup day open. A bearish harami pattern is the exact opposite. It appears in an uptrend with the setup day a long bullish candle followed by a signal day short bearish candle.

When this pattern appears, it means a trend reversal. This pattern has a few variations. One important variation is the Harami Cross. In case of a Harami Cross, the setup day is a bullish or bearish long candle and the signal day is a Doji. Doji is formed when the open and close are the same. This is not a common pattern but when it does appears, it means a sudden trend reversal.

When this pattern appears and you want to trade it, you can use the close of the setup day as your stop loss. Sometimes, using too tight a stop might get you out of a successful trade. However, putting a stop loss with enough room can keep you in a bad trade too long. Where to place the stop loss is an art plus a science and it is one of the most difficult parts of trading.

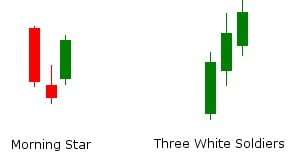

The Morning Star And The Three White Soldiers Candlestick Patterns

This is a guest post by Ahmad Hassam

Three stick candlestick patterns are more complicated than the single stick and two stick patterns. These patterns take three days to emerge as a valid signal. One such three stick candlestick trend reversal pattern is the Morning Star. However, a Morning Star and the Bullish Doji Star look almost the same but are in fact two different three stick candlestick patterns. You need to know how to distinguish between them.

In case of the Morning Star and the Bullish Doji Star Patterns, the first day is a large bearish candle, the second day in case of the Doji Star Pattern is a True Doji while in case of the Morning Star it is almost a Doji. The price action behind these two patterns is almost the same.

The first day is a down day with a large bearish candle forming as happens in a downtrend. The second day starts with a gap opening indicating that bears are still in action and are continuing to push the prices down. For the rest of the day, there is a tight contest between the bulls and bears and the open and the close price are almost the same. The third day is extremely bullish with the bulls pushing the prices up regaining the lost ground on the last two days. When either these two patterns appear on the chart, it means a trend reversal.

The other important bullish trend reversal three stick candlestick pattern is the Three White Soldiers Pattern. This pattern includes three bullish candles in a row. When you spot this pattern in a downtrend, it means a quick trend reversal.

In order to identify the Three White Soldiers, look for three consecutive up days in a downtrend. Now, if the open, close, high and low of the second day are higher than those of the first day and the open, close, high and low of the third day are higher than those of the second day, you have spotted a true Three White Soldiers Pattern.

The price action that forms this pattern is often dramatic and indicates a quick trend reversal. The appearance of this patterns means that the bulls have been in total control of the market for three consecutive day. The Three White Soldiers is considered to be a pretty strong trend reversal pattern. It is always a good strategy to put the stop at the low of the Three White Soldiers pattern’s second day. This way, if there is some retracement after the new uptrend, you don’t get out of the trade soon.

Deciding on a Lot for Your Forex Trading

As a Forex trader, your natural desire is to reduce risks as much as possible. Inevitably, you develop risk management strategies to combat the side-effects of risky trades. In doing so, Forex traders must pay close attention to the size of their lots. Forex strategists assert that the smaller the lot size is, the better, consequently boosting flexibility and overall risk management. So what are the types of Forex slots? Forex slots come in three forms: 1) Micro Lots, 2) Mini Lots and 3) Standard Lots.

Micro Lots: This is essentially the smallest available size capacity tradable by the regular broker. A micro lot comprises of 1000 units of your overall funding currency. Say, for example, your account default currency was the USD, you’ll be trading $1000 worth of your regular currency. If you are using a dollar pair, keep in mind that your one pip is equivalent to ten cents. This is the least riskiest and a perfect start for beginners.

Mini Lots: superseded micro lots and have continued to be of significant to Forex traders today. However, mini lots have become an expensive commodity, for each dollar on a dollar based pair trade demands 10,000 units of currency funding. This means that each pip is worth $1 in a trade. Therefore, you need to have enough capital. Consider the insane fluctuations of the market, you can either get $100 in an hour or lose $100 in 2 minutes because the Forex market is so unpredictable. You’ll have to decide how much risk you can handle before you make comfortable and uncomfortable decisions.

Standard Lots: In order to trade using a standard lot, you’ll have to have 100,000 dollars wortth of trades. This is because each pip size is on average $10, so that means that losing $100 has a common occurrence. These are often provided and maintained by institutions. You have to invest significantly to afford this kind of lot, about $25,000 to make your trades worth while.

At the end of the day, it’ll depend significantly on your risk management, your investment, and the overall organization of your trading. The best option remains within the micro lots, since mini and standard are accompanied by significant investment needs including lots of risks.

How to Be a Top Forex Trader

In the Forex market, everyone wants to become the infamous powerhouse broker with an unending stream of money coming out of their pockets. The reality is, according to Forex brokers, 90% of traders fail terribly because they just do not know what they are doing, how things work, or that they aren’t prepared enough. The other 10 percent, well, consider that only 5% comes even while the other 5% experiences repeated success. How do they do it? In this post, I’ll explain five key principles required to become a power trader:

1) Education: these traders aren’t your everyday traders, they know the ins and outs of the Forex market and so they have significantly invested in their knowledge to the point where they know each aspect of the Forex system. They also learn from each successful/unsuccessful trade and develop strategies to decrease their risks–they are constantly learning.

2) A Trading System: these brokers have a solid Forex system whereby their trades are enacted with as much strategy as possible. They are on a system that pushes them towards discipline and are very aware that if the Forex market signals their system, then they probably have a higher chance of success.

3) Price Action: based on the market trends effecting prices, repeatedly fluctuating, these Forex traders know that if their prices match according to their strategy (often using Candlestick method), they can fully do their trade.

4) Manage Money: these brokers are knowledgeable about Forex market to the point that they exercise humility and diligence because not all Forex trades become successes. They have a way to manage their risks and avoid as much loss as possible.

5) Psychology: Forex requires a lot of hardcore unemotional behaviour because being a hypochondriac is simply not the way to be successful. They don’t cry after every failed attempt, for they know it’s been a gamble. So they are understanding that each trade can give them success and failure, there are two sides to every action.

These five factors are important, I believe, particularly the psychological aspect for Forex trading can become emotionally devastating. In the end, what makes you successful and what makes you lose is pretty obvious, the success is governed by rigorous determination and emotional control.

Keep A Trading Journal

Why you need to keep a trading journal? Trading is all about being disciplined. Successful traders don’t have any holy grail of systems or indicators. What they have is a lot of common sense and discipline. The importance of keeping a trading journal cannot be overemphasized if you want to become a successful trader. This is how hedge fund managers train their new traders. No doubt, leading banks are able to train and breed successful and pro traders using this simple strategy of inculcating the habit of keeping a trading journal and being disciplined in trading.

As an individual trader, keeping a trading journal is even more important as you are trading with your own money that you can’t afford to lose. Capital preservation should be your number one strategy. Live to trade another is what you need to learn and inculcate in yourself.

For every trade that you make, you need to have a strong rationale for entering into the trade with clear cut entry, exit, take profit and stop loss strategies. When you enter into a trade, you should know beforehand when you are going to exit in the worst case scenario. Learn to manage risk first and only then think about taking profit.

Many traders think of the profit first and risk later. It should be other way around. First manage risk, once you have managed risk, only then you should think about take profit. Learn to take a calculated risk each time you enter into a trade plus develop the habit of learning from your mistakes. Now your trading journal need to have at least the following three parts. Let’s discuss them.

Currency Pairs Checklist: This part should include your daily outlook on the different currency pairs that you trade. Calculate the daily range of the pairs that you trade using pivot points. Predict how the currency pair is going to behave in the next few days. Mark those currency pairs that are ranging with their support and resistance as well as those that are trending.

Potential Trades: This part should include the list of trades that you plan to trade in the day plus the strategy that you will employ.

Completed Trades: This part should audit all your completed trades. Try to learn from your mistakes. Analyze each completed trade. Figure out where you went wrong in case of a losing trade. In case of a winning trade, think if you could have done it better.

Bad Risk Management in Forex Trading

Bad risk management can create stress and ruin your forex trading career. You might have the best forex trading system in the world but it will fail if you don’t practice good risk management. Losses are inevitable with any forex system. But what if you have bad risk management? You will blow out your account soon and most probably don’t have enough money to make those profits that you had dreamed when you started trading forex.

Bad risk management is one of the main reason that fails the budding career of many new forex traders. Many people start trading forex dreaming of making a million in just a few months. They overtrade, take on too much risk and get blown out by the market.

Many buy a great forex system, make a few trades that are way too big for their equity in the account. When the first few of these trades go wrong, they lose almost all their equity. After this they think that forex trading is a lie and quit.

What is more important for you? Capital preservation or capital appreciation? Of course capital preservation. Learn to survive the market and trade another day. Suppose, your system makes only 10% return per month with a risk of only 1%. Is it better or is this system better that gives a 50% return per month with a risk of 10%. Naturally the first one is a better system. Let me explain.

Suppose, you have a coin and you have $100. Your friend want to bet $10 dollars for every flip of the coin. You and he agree to make 1000 flips. Ideally if you win all the 1000 flips, you will be making $1000. But if you lose all the 1000 flips, you lose $1000. But you have only $100 in your pocket. So, how much maximum to bet on one single flip of the coin?

If you bet $10 on each flip, you will have 90% chance of getting wiped out in 1000 coin flips. In those 1000 flips, you just need 10 losing flips to lose your $100. So, what to do? Let’s say, you tell your friend that you are ready for the bet but with only $1 per flip.

Now, what are your chances of losing all your $100? Only 5%. You see, you need 100 flips in a row to lose $100. This makes your risk of losing only 5%. This is exactly how you need to take the game of trading.

It is risk management that is going to determine how fast or how slow you grow your equity. Your equity can grow very fast if you take too much risk but you might as well get blown out soon too. On the other hand, take too little risk, your equity may grow slow but you have very little chance of getting wiped out. Whatever, you need to understand that it is not the pips that you make that determines how much you make with a forex system but risk management that determines how much you will end up making with those number of pips.

Subscribe to:

Posts (Atom)